If the Bill Payment relates to a 1099 vendor, we recommend using a wash account (instead of the expense account) for the journal entry and re-issued check.

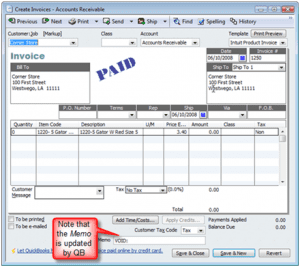

The journal entry will reverse the activity in the current period. Journal Entry Example – Journal date : Account To create a journal entry in online go to the Create icon > under the Other column click Journal Entry. To create a journal entry in desktop go to Company > Make General Journal Entries. Step 2:Ĭreate a journal entry in the current period, debiting the same bank account and crediting the expense. Voiding a Bill Payment could cause issues if it was used to purchase inventory, or pay a 1099 vendor. It is not recommended to void a Bill Payment in a closed period. Make a note within the memo of the original Bill Payment and re-issue the check noting the current period date and new check number by way of a journal entry. Note the account or items affected, and use the same account to book a journal entry. Therefore, you want to perform the following steps: Step 1:įind the Bill Payment within the Vendor that needs to be re-issued.

You do not want to delete or void the check as this would cause problems. You need to re-issue the Bill Payment check, but it was in the last fiscal year and the books are now closed. A vendor you paid via Bill Payment in QuickBooks lost the check.

0 kommentar(er)

0 kommentar(er)